Modern economics and Gaussian distributionĪs explained in the above section, the thesis was forgotten until 1964 when it was translated into English and modern economics started to be built on it. They are the outliers, unlikely events that should occur once every hundred years. 68% of the changes correspond to small variations around the mean (i.e.With this model the variation of prices can be assessed. It seemed a simple and elegant way to find order within the chaos and randomness. In this way he described the standard deviation mathematically and created a simple mathematical template with which to measure dispersion. That is, the outcomes are independent events. The so-called random walk model he developed asserts that prices would rise or fall with the same frequency, in the same way as a coin toss. His doctoral thesis Thèorie de la Spèculation, which was not without controversy at the time, dealt with speculation as a business. Quantitative analysis of financial markets started with Louis Bachelier in 1900 who developed a new theory of probability based on Pascal and Fermat's 17th century studies of probability.

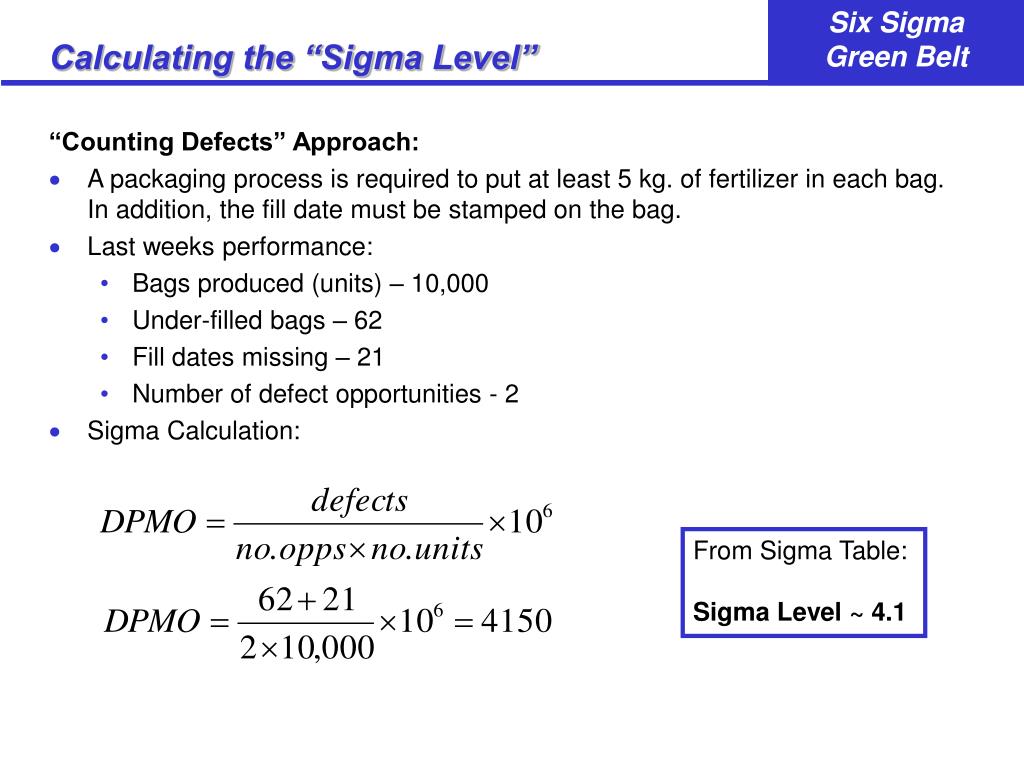

#2 sigma calculation how to#

Let's see how to compute a Gaussian distribution in Python: \(\operatorname )\)Ĭalculating Gaussian distribution using Python The mathematic form of a Gaussian function is as follow: Or because of the shape of the graph, it is also often referred to as a Gauss' bell. Gaussian distribution is one of the most frequently observed data distributions in nature hence, it is thus called normal or standard distribution. A normal or Gaussian distribution is found repeatedly in nature, such as the people/animals’ height or weight, the speed in a race, IQ, etc. Gaussian distribution, normal distribution, bell curve, Gauss' bell. If the mean is zero and the variance is one, we call it a standard normal distribution.

This, therefore allows us to make predictions about an unknown value when we already have a set of known values that follow a Gaussian distribution. To be specific, a Gaussian distribution is symmetric and has a constant mean and variance. In the Gaussian distribution, most of the data are concentrated around a measure with a certain dispersion or variance. The Gaussian distribution is so common that it is often called a normal distribution. Or in honor of its discoverer sometimes it is named as Laplace-Gauss distribution since Gauss based his research on Laplace's studies.ĭifference between Gaussian distribution and Normal distribution The name Gaussian distribution comes from the mathematician Carl Friedrich Gauss who realized the shape of the curve while studying the randomness of errors. Why is it called a Gaussian distribution? The Gaussian distribution is used in a generalized way to describe the behavior of prices, in this post we will try to understand a little better this distribution and the implications it has on the financial world and risk control. Such as the binomial distribution, the Poisson distribution, the Cauchy-Lorentz distribution, etc. When we are working with data in statistics, one of the most fundamental analyses is to check the data distribution.ĭepending on the nature of the data, we can find different distributions. What is the Efficient Frontier Portfolios theory?.What is the Black-Scholes-Merton model?.

0 kommentar(er)

0 kommentar(er)